Canadians Need to Stop Using Mutual Funds - Opt for ETFs instead

Canadians Need to Stop Using Mutual Funds - Opt for ETFs instead

This one is for my fellow traders & investors in Canada.

It almost seems unbelievable but even today in 2021 - a lot of Canadians are still buying into Mutual Funds. Why you ask? By no fault of their own. They are heavily pushed by all the big banks - boo on them for that. They are doing a big disservice to their clients - who eventually will get smart enough to ditch them.

Why do I say disservice? There are more than 2 decades of studies in the US markets now that Mutual Fund managers as a whole are no better (probably worse) than monkeys throwing darts when it comes to picking stocks. John Bogle has been a great champion for that and built an entire industry around it (Vanguard).

Given that there are no reasons why anyone should be paying these monkeys 1.5 to 3 percent of assets under management as fee. ZERO Reasons. Just buy an ETF and save your 2% year over year - over time you will save quite a bunch. I am not even linking any articles for that - just google for "advantages of ETFs over Mutual funds".

There are a number of very smart Canadians that have provided templates on how to go about getting into ETFs - read-up folks. Stop paying unnecessary fees to the big banks.

Here is another link with some more info:

https://www.savvynewcanadians.com/best-etfs-canada/

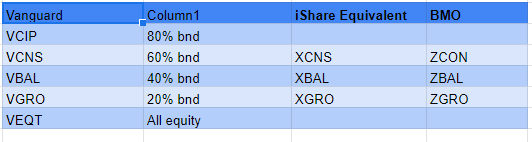

If you want a cheat sheet - here is what I have on my watch list:

All you need is to pick one of these or maybe two and rebalance every year or so if needed. For more focussed exposure to various other asset classess:

VNQ, IYRREIT (US with Options)REETGlobal REIT ETFVRE, XRE, ZRECanadian REITsXEI, VDY, XIU, XDVCanada dividend etf

Throw in FPI and LAND if you want exposure to Farmland REITs. And generally, with these options, you can stop hunting for dividend-paying stocks as well - getting rid of any single stock risks that you really don't need to take. Ok.. I am now side-tracking from the main content for this post.

With an average of 0.1-0.3% or so in fee for these single fund ETFs from any of these major houses, you can say bye-bye to your fund manager who has been fleecing you with 2-3% charges for decades now - and to the big banks that have been housing these thieves.

Happy Trading - now go save some dough!

-gariki