Experiments with hedging a short premium portfolio

Experiments With Hedging A Short Premium Portfolio

Note: Kickstarting the blog with republishing a couple of articles I've posted to LinkedIn a few years ago (can't believe it's already been 4 years now; time flies).

Flavor of this week is investigating portfolio hedging for a general short premium SPX derivative book. If you are into this kind of thing, generally accepted hedges are teenies or long VIX calls. Here is an excellent article comparing the two and for some background info.

Problem with buying either teenies or VIX calls is its outright cost. And who likes paying for insurance? So let’s see if we can find ways to find that elusive “free insurance”.

Let’s just dive in and look at a few options all available in the public domain. But before that let’s be clear that our objective is to protect a short vega portfolio from a black swan or a quasi black swan – say anywhere from 10% down to 20% down or more.

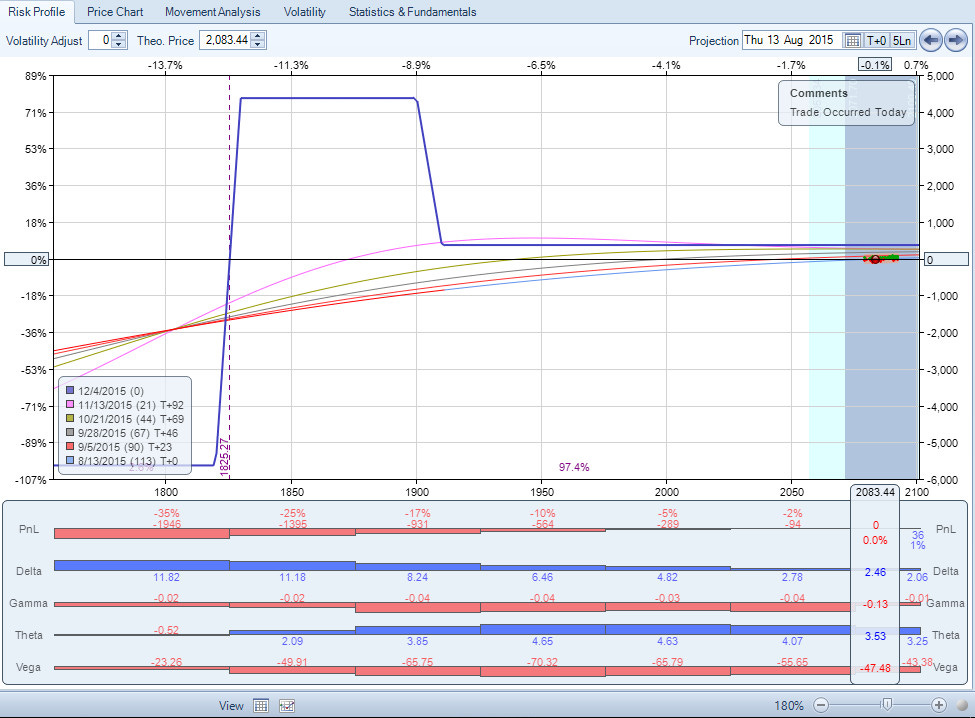

One option is to sell structures well below the money with the expectation that as time passes a hump will develop that will protect the downside. The starting structure might look something like this which you might recognize as a space trip like trade.

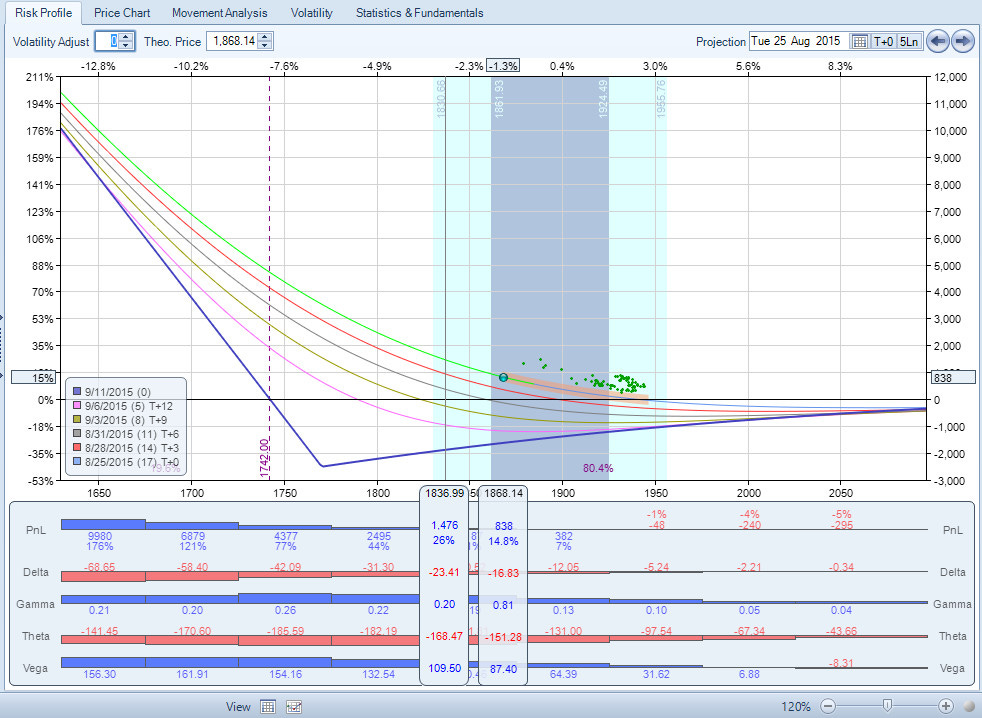

At first look, this seems quite good. Given a modest amount of time, a hump will form below the money protecting the ATM structures. One problem is that the family of curves (t+n family) all curve downwards – a possible solution is to add teenies in front months. It will make the pnl curves look as follows:

This looks excellent now. The curves are leaning upwards, and with any vol increase, it should payoff well and protect the portfolio.

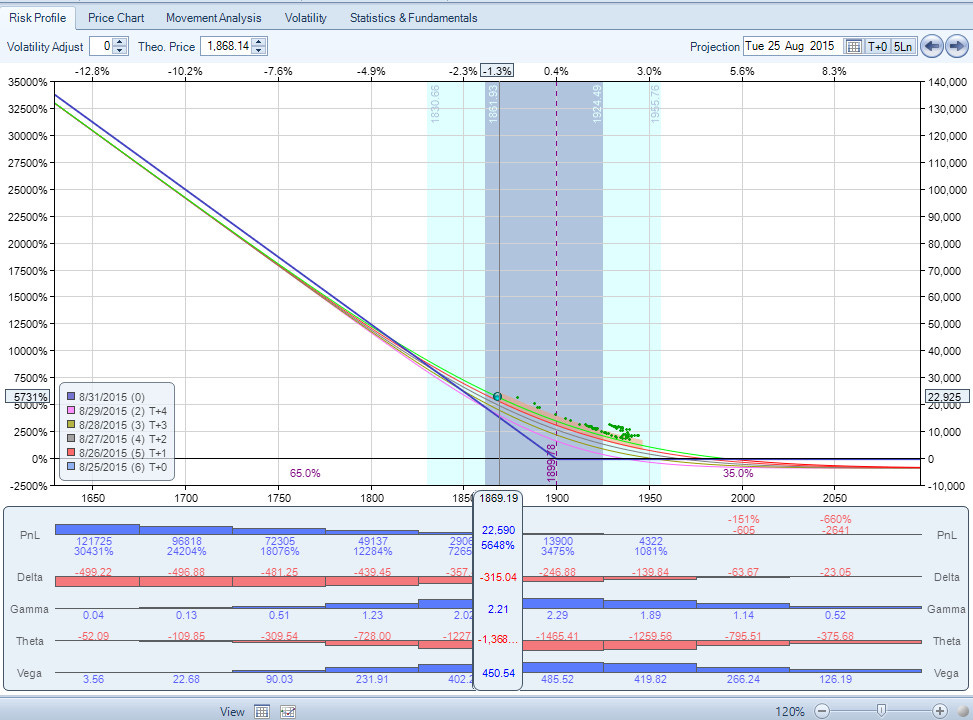

Now let's compare this with a simple teenie trade. Notice the max risk for the above variant is about 2100$. Now for the teenies trade, let's buy a 5 lot of 20DTE teenies costing around 400$. They are kind of comparable since if we do a campaign-style rolling of these puts as time gets closer to expiry, we will end up buying this 5 lot about 5 times in a 100 day time frame (same time frame as the space trip variant) costing us a total of 2000$ (400*5). So far it seems like the below-the-money structure is good since at current prices it’s a positive theta hedge that seems like it will provide good protection in a big down move.

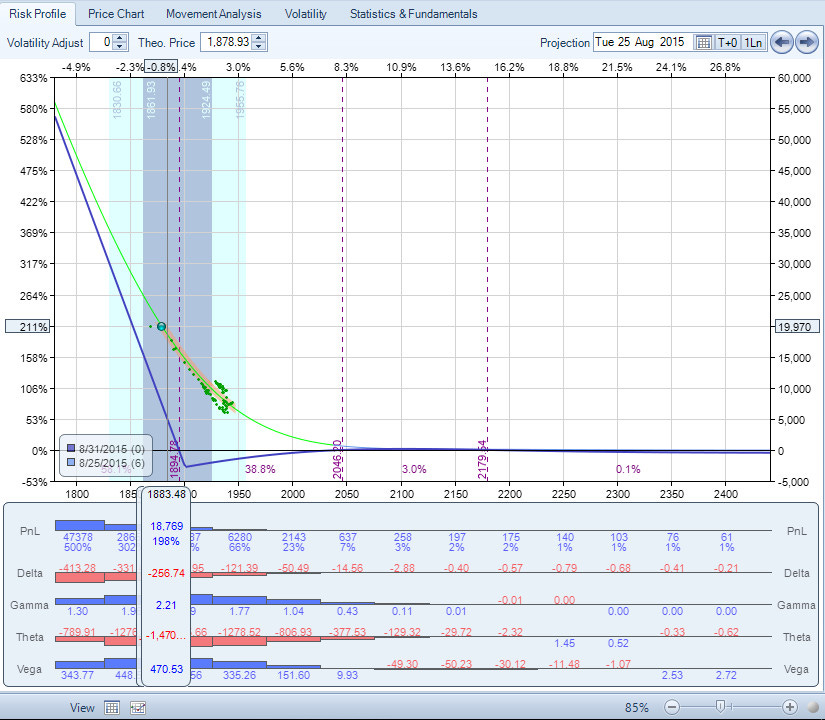

All the above numbers are produced using a backtest from around August 12th, 2015 to about the 30th of that month when the spu’s did a nice big down flush. Fast forward now to Aug 25th after the down move and the STT like trade looks as follows:

Down 1670$ - hmm where is the hedge part? Ok, but we knew it in advance itself that without the time needed for the hump it's no good. How about the one with a teenie added:

Not bad. Up 800 bucks compared to being down. But if this was supposed to be your hedge trade for the rest of your book, maybe it did not provide enough of it. Let’s see what the simple teenie buying would have done:

Up 23k. Now that is a hedge. But what about the cost of the hedge? Yes we had to pay 400 bucks but it did its job right. And this was only like down 10% in the SPX – if we have another 5 or 10% move down, the effects are even more pronounced.

Another thing to note is the cost of execution and managing the trade. For the teenie campaign, it's relatively straight forward it’s just a 5 lot. For the STT like structure, the commissions are at least 10 times as much (more actually).

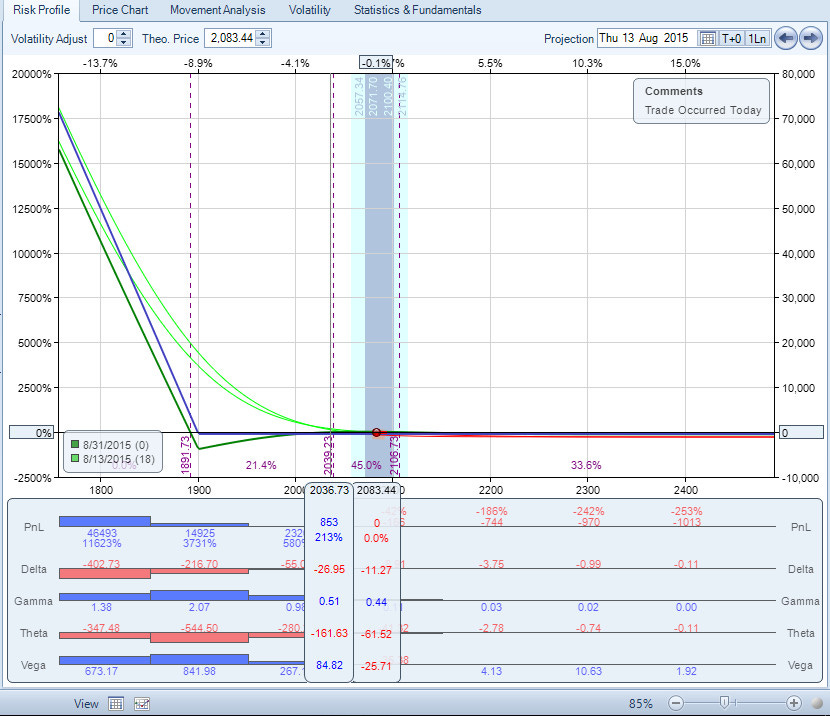

Given the above, it seems like though the idea of getting free downside hedges is very appealing at first sight – it’s not really going to work. Like they say there truly is “no free lunch”. Seems to me like it's best to chalk the outright teenie cost as a cost of doing business and perhaps trade slightly bigger to make up for the cost. Hmm… that’s not too hard to test. Let's add a 50x80 slightly below the money Roadtrip trade to the teenie – so that the upside risk to the hedge is not increased but some lost insurance cost is recovered. Here is how the t+0 looks like on day 1.

Note the green line not adding much risk to the blue to the upside but around -9% there is a small “valley of death” – very similar to the space trip variant with the teenie added.

Here is how it looks after the down move on Aug 25th.

Hmm... Not bad. Specially if you are already trading ATM structures, this adds a good hedge while changing the trading routine minimally.

Like the title says, finding a good hedge is a perpetual exercise. For now thought, it seems to me simple is better. If you find or know any better way to hedge a short vega portfolio I am all ears.