Recently came across a nice slick website (financialjuice.com) publishing MOC imbalance information via some presentations from the good folk at Aeromir, who have been looking at it a bit as well.

So let’s put our quantitative hats on - and figure out if there is an edge in moc imbalance data.

And if there is, is it big enough and usable enough for a retail trader to do something with?

Before we dig into the weeds.. let’s get a few basics out of the way.

What is an MOC Order and what is MOC Imbalance?

Our other good friend, Google, says this about moc orders and when they are executed.

and

Ok. That’s simple enough.

Now what kind of edge might that present?

If an imbalance of orders is to the buy-side, it means there are more buy orders that are coming into the market at close than sell ones. And you would think market would wiggle upwards.. reverse if there is a sell-side imbalance. That is the hypothesis.

This though process though is simple, having this insight and having this hypothesis is very critical for any quantitative analysis. Otherwise, you might easily fall into the land of data mining trying to curve fit your thinking to outcomes - and that’s a very slippery slope.

What should you be testing for?

How about market movement from the last print of MOC imbalance, 10 minutes before market close to say 15 minutes after the close. At this point, all the moc orders should have been executed and if there is any validity to our hypothesis, it would have come to pass.

Another thing you could test is if from closing bell to the next market open the imbalance would have a sway on the market. Plausible, but given there could be so many other things that could come to pass overnight, I much rather like to see what happened immediately after close than the next morning.

Ok so now we know what to test.

How about we roll our sleeves and get dirty with some data. Ideally, it would be nice to have a platform to be able to write some sort of a script to tease this data out.

Anyone willing to pay bloomberg to maybe get some api access to spit this data out to be able to be programmable, message me privately. Heck, maybe financialjuice provides this info in a downloadable format for easy consumption.

Let’s just start with a quick and dirty way - good enough for a small pilot.

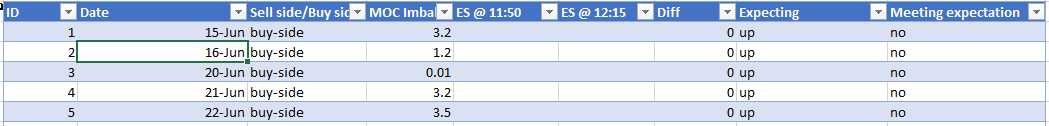

Here is a sample data set I want to collect. Ideally, I like about 100 sample points but say 30 samples or even 20 is good enough to get a rough feeling for it.

And why ES? Because since the orders will execute just after close, if there turns out to be an edge, it can be realized using the emini.

Once we have some data, we can slice and dice it a few ways to see if it’s worth it.

So now, someone beat me to it, collect data and send it to me.

Until next time.

Adios

-gariki