Money Market Magic

Another excellent article from John Hussman. Totally worth reading (and re-reading.. I have’nt understood all of it in one reading. Maybe won’t in second either).

Here’s where he explains how money market funds work.

That, in turn, requires another special “facility.” See, if banks are being paid interest on their cash without passing it on to their depositors, people tend to move the deposits to money market funds. The money market funds aren’t banks, so unless they hold the funds as bank deposits, they’ll chase yield in short-term securities like Treasury bills, driving market interest rates below the Federal Reserve’s target. As a result, the Fed can’t maintain its interest rate target without somehow stopping that yield-seeking behavior. Since the Fed can’t legally pay interest to money market funds, and refuses to manage interest rates by changing the size of its balance sheet (as it did for all of history prior to 2008), it has created a new “overnight reverse repurchase facility,” where the Fed sells one of its own securities overnight to the money market fund, and takes the cash overnight from the money market fund, and then buys the security back the next morning at a slightly higher price, resulting in a little gain to the money market fund. This way, the Fed can keep holding the securities instead of investors and money market funds holding them. It’s as ridiculous and contorted as it sounds.

That said, ponder up the idea that markets are so wonderfully hard and complex that for someone this smart, it has been super hard to keep up with them.

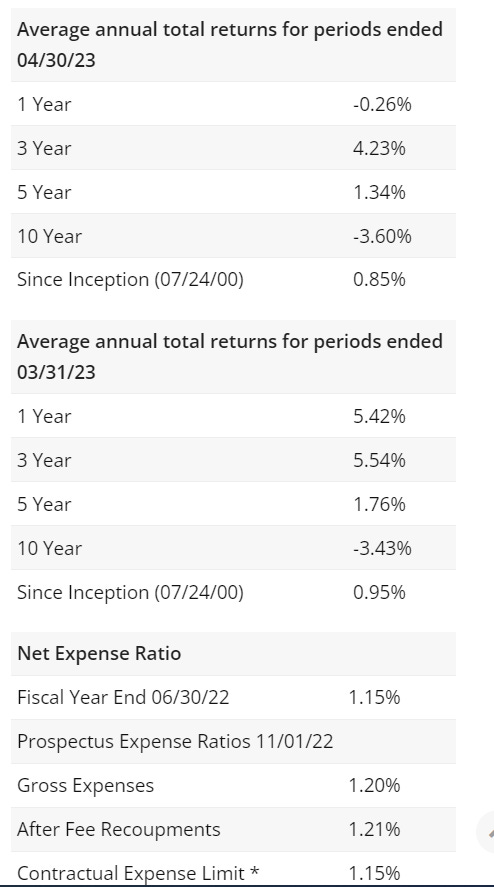

Their key growth fund performance metrics are below:

-3% over the past 10 year period while paying a bit more than 100 basis points (or is it 200+) to manage that money. No thanks. Most people would probably do just fine with a broad market ETF.

But think about this: for retail traders who come in with expectancy to make much better than market averages, not to speak who want to double and triple their money. Keep it tempered..

Until next time.

-gariki