Tesla Option Income Strategy ETF (TSLY)

Recently a good friend asked if the Tesla Option Income Strategy ETF is worth looking into. Single stock etf with options selling as base.. Quick answer: Sure I suppose. If you want some long exposure to TSLA.

For a primer on call selling against long stock - check this out.

With the basics covered. Let dig deeper into TSLY.

I would assume a proper covered call ETF calling itself “option income strategy” on TSLA would have a laddered selling program in TSLA options spread across time. So you would typically sell across time, anywhere ranging from 50-60 delta calls to maybe even far out 5 delta calls to collect some premium.

Done right, you would probably be laying off 30-35 deltas over plain old TSLA stock risk-wise while still participating in upside if TSLA were to shoot up.

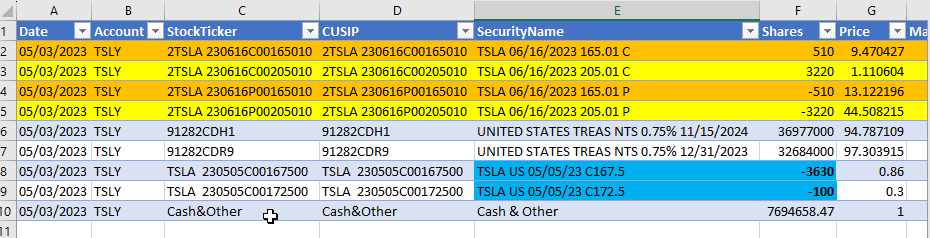

Looking at what’s in TSLY though:

Mostly they are sitting in US T-notes returning 0.75%. Why the heck can’t they hold paper returning more like 4% that we can do in public bank accounts even. Even hold something like CASH that will return 4% yield on cash. Maybe it’s their brokerage rules that they have to stay in US T Notes against their short options perhaps?

Moving on. On the TSLY portfolio itself - surprise no TSLA stock holdings at all. Just long 205C seems like and sold 165 Calls against it (most likely) - all in 06/16 cycle. We do have to make some assumptions since their position is not clearly published.. then a bit of position in 165 puts and 167.5 puts between May/05th and June 16th position. Assume long june and short may. Or maybe they are short puts in both the cycles. Or maybe they are short these two puts and long the two calls given the positive sign for the two calls listed on Morningstar. So sold puts and financed to buy a bunch of calls; not a great way to make income but its ok.

With TSLA around 160 bucks as I write this - not very diversified I would say. Neither across time; nor across price. Not too impressive.

Let’s try looking at the horse’s mouth to see if we can tease more out:

https://www.elevateshares.com/tsly/

Whoa.. 75% current yield. That’s suspicious: but looking at yield returned over the past few months, returning about a buck per month on a 13$ underlying. Impressive.

Again. Returning close to a 100% return on an option portfolio if market works in your favor is not unheard of.

What’s excellent is they do have their entire book posted on their page. That’s really nice.

Let’s decipher this a bit: super small book. Should’nt be hard:

I have marked in yellow and orange above what seems to be their core position. Long call and short put of 3220 and 510 lots. Essentially their long stock equivalent (in June cycle).

Against that, they have sold May 172.5 and 167.50’s. 3630+100=3730 lot. One to one matching their long equivalent. Superb. That’s their entire book.

How does the risk-reward look like: lets look at the core part of it (the 3220 lot counterparts) to make my life easier.

If the market rolls/crawls/crashes up - they take home roughly 2$mil on a risk of roughly 50mil. Do that 12 times a year and that explains significant part of the expected 75% return. This explains the theta - that’s paid out in dividends.

Now, back to our original question - is it worth putting money into it? That turns out is not quite as straightforward.

Let’s look at the risk - if market rolls lower and or crashes - there sure is a lot of risk to the downside (to the tune of 50mil). The fund can get into some rough waters if the stock moves anywhere from even 10-15-20% down. AND that sure can happen. Ask anyone holding safe banking stocks (for dividends anyone!).

But here is the hard part - if this is risky. What is better.. that really depends and that’s where there is never any good answer in finance. It all depends on your risk tolerance; your expectancy etc.

For example, say you do want long exposure and you think TSLA would go up in the next 6 months.

You could try an unbalanced condor to the upside - risk to reward is a whole lot better than 50 to 2 (very close to 1:1):

You could try an upside unbalanced fly. Or a call selling program while holding longer term calls instead of stock equivalent (aka. poor man’s covered call). Not that it’s any better though. Different risk-reward profile. Having a base position with stock is cleaner - you would’nt be bleeding theta in it.

Also, it matters what level of confidence you have in your market signal that your long bias is based out-of. Is it based on a mechanical system? Is it reproducible? How much of edge is there actually in the signal? What is the average expectancy for the signal? Then back-test alternate options to pick the right one.

Yes. Not simple. It never is simple in finance (though many times it appears to be). If I were putting some cash to work in this ETF, I would use caution and go small.

Until next time.

Good luck trading!

-gariki