MOC Imbalance - Is there an Edge? (Part-2: The Verdict)

Continuing from our Part-1 where I presented a basic hypothesis as to where an edge might exist in MOC imbalance data and setup a test to verify it, here let’s look at some real data and see if we can tease out whether there is a usable edge in moc data.

Quick Note on Data:

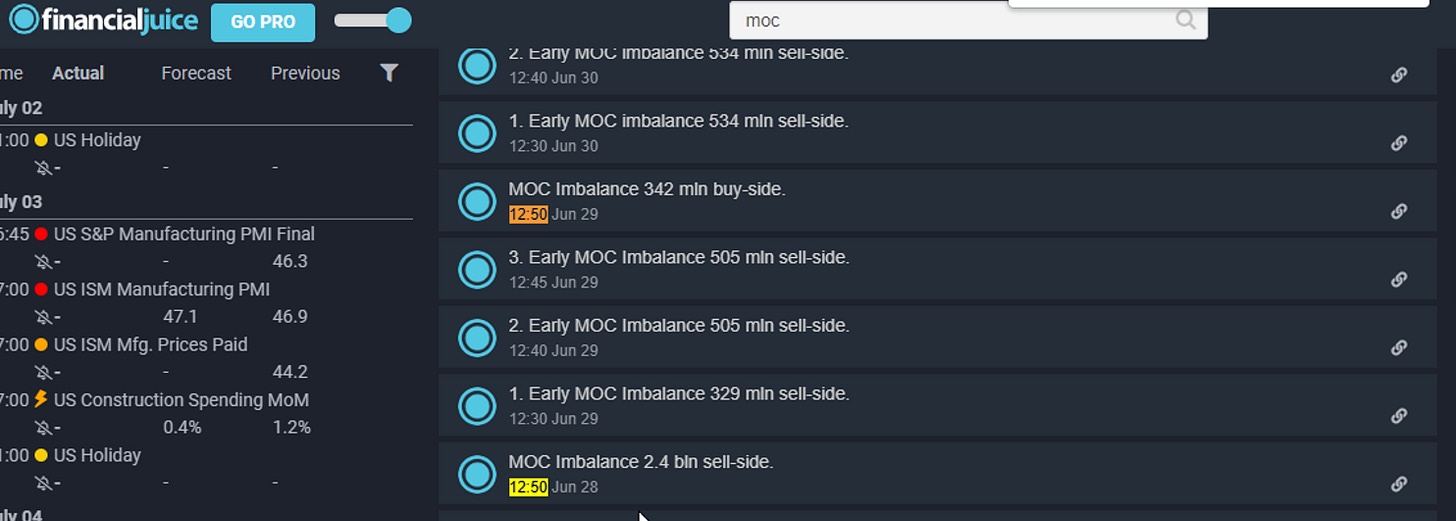

A reader noted that Market Chameleon (MC) has moc imbalance data as well. Taking a quick peek, data is delayed by 15min for a free account so it’s pretty much useless for this study or for real transactions but it’s good to see to compare against data from financialjuice(FJ).

For example on 28th June, MC shows a notional difference of about 1.4billion.

And FJ shows a sell-side imbalance of 2.4billion.

It is consistent in direction from the samples I have seen but FJs data is generally about twice as large. Perhaps one of them has more underlying’s they are measuring the order flow for.

For this study though, it’s kind of irrelevant as long as you stick to one data source while testing and going live. Nice to see an alternative data source though if needed.

With that said, now let’s dig into data.

Here is a screenshot of data collected (33 data points). Includes sell-side and buy-side imbalances – about half each.

Excel sheet can be downloaded if you want to play with it. There are a few formulas to make life easier but mostly self-explanatory.

Dispersion of MOC prints:

About half of them are above the 2B line (Y-axis).

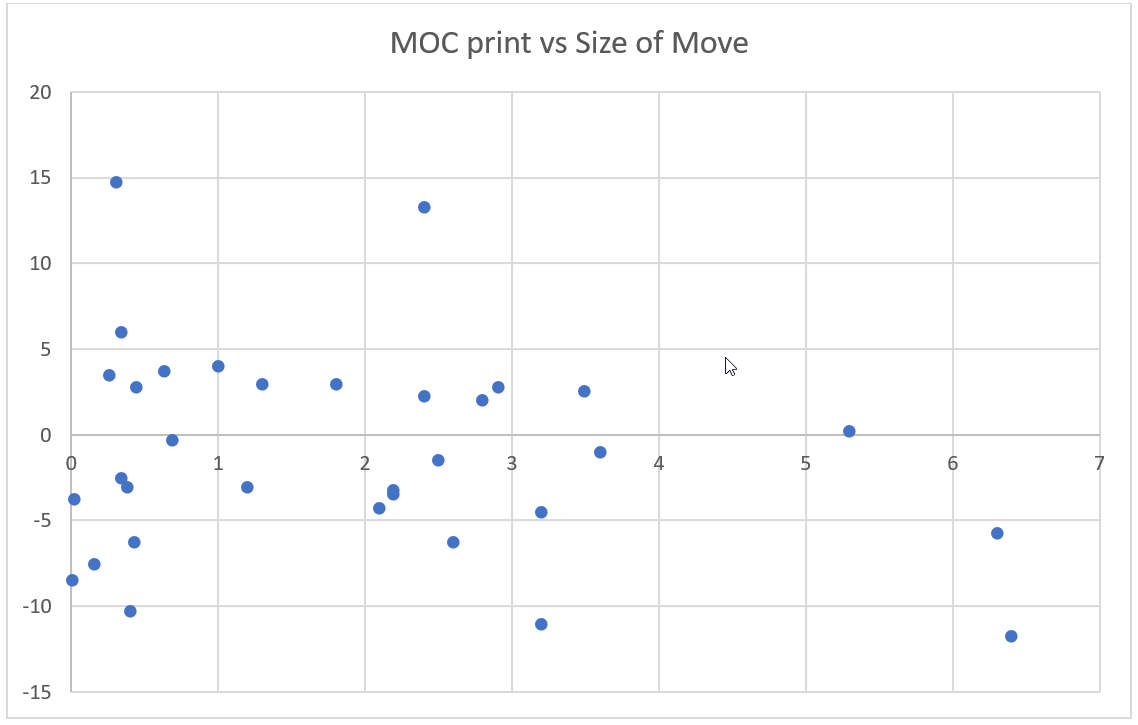

Here is a scatter plot of MOC print (x-axis) vs size of move (y-axis):

There is no clear correlation between size-of-move and moc print. For example, there are >5pt moves at moc print greater than 6 but there are enough of them with moc prints below 1 as well.

Here is a scatter plot of MOC Print vs PnL (y-axis):

Though the ones above 6B print are both positive, there are enough negative pnl occurrences above 2B print that if you use 2B as cutoff will offset the 6B print pnl. Perhaps extreme prints are what that have value. Need to find more prints above 5-6B to make any inferences about that.

Filtering prints greater than 2B cutoff, here are the numbers:

16 occurrences. Sum of 5.25 and an Average of 0.33 – not enough of an edge if you account for spread (even if you ignore commissions). Given this is not enough occurrences to hang your hat on, not very promising either to do a larger study.

Directionally, 11 are in the direction of the moc print while 5 against it. But even with that the average pnl is not enough to get excited about. If over more occurrences this gets more balanced i.e., more incorrect directional moves, then this small perceived edge might also vanish very easily.

PnL per trade in bar chart form:

Basically, there doesn’t seem to be a good consistency wrt forecasting the direction of the move, nor the magnitude based on the moc print.

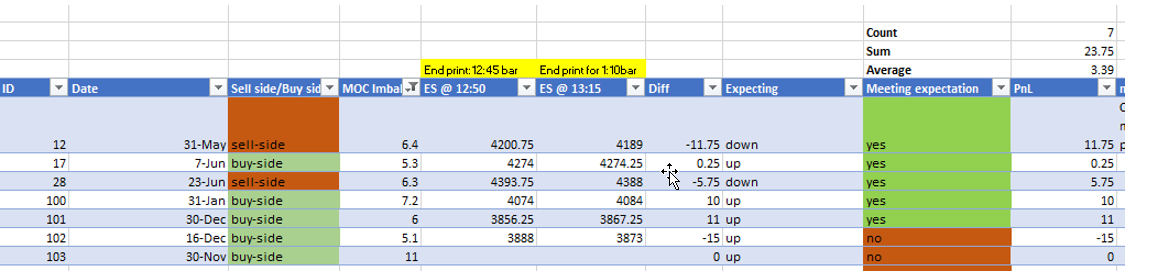

Trying to hunt for occurrences with a MOC print greater than 5B, found only 7 occurrences in the past 180 days (TOS data for 5min bars only goes back so far).

Here are the results for MOCs > 5B

There is a positive expectancy but this data set is very sparse. One note though, even if we have a lot more of this data, it would be hard to wait for months on end waiting for a signal – there are zero occurrences between Jan and May of this year.

Few additional Observations:

Pic below shows a big move before the 12:50 print. The highlighted bar below is timestamped at 12:45 and imbalance is 2.8Billion. So, most likely the mocs at 12:30 and onwards are pointing in the same direction as well – could that have caused these big up moves in anticipation?

Perhaps we are better off looking at the direction of imbalance at 12:30 print and taking directional position. Something for someone else to test and run with.

A few additional observations noted in the notes column in spreadsheet.

Data using /ES data from Thinkorswim

All timestamps in PST

Summary:

Somewhat disappointed that there is not enough of an edge to use here but a good exercise – a fun little project worth doing.

Then again, this is exactly why you should always put some parameters around any trading idea and test it. I have written about it in the past here and here for example.

Or you just have to be super lucky - which is actually preferable in some way.

Do you have friends or family members who might benefit and enjoy reading our content? Spread the joy by sharing this content and/or leave a comment.

It means a lot to me if the content I am creating is reaching more folks who can use it and enjoy reading it.